Catalysing Climate Finance for Low-Carbon Agriculture Enterprises

Climate finance represents a critical opportunity to bring investment and innovations to agricultural settings to improve resilience and drive new and more inclusive low-carbon development plans. With 80% of the food and 40% of jobs in sub-Saharan Africa and South Asia tied to small-scale agriculture, rural households must be central to these plans. However, small-scale agriculture value chains and the financing institutions serving them currently account for just 0.2% of the roughly $600 billion in tracked annual climate-related financing globally.

80% of the food and 40% of jobs in sub-Saharan Africa and South Asia are tied to small-scale agriculture … yet just 0.2% of the roughly $600 billion in tracked annual climate-related financing globally goes to small-scale agriculture value chains and the financing institutions serving the sector.

New research from the CASEE programme – commissioned by Shell Foundation, co-funded with the UK’s Foreign, Commonwealth and Development Office (FCDO) and conducted by Duke University and RMI – examines this disconnect in the context of small agriculture enterprises using renewable power to improve productivity and resilience of rural communities in India and sub-Saharan Africa.

New research from the CASEE programme – commissioned by Shell Foundation, co-funded with the UK’s Foreign, Commonwealth and Development Office (FCDO) and conducted by Duke University and RMI – examines this disconnect in the context of small agriculture enterprises using renewable power to improve productivity and resilience of rural communities in India and sub-Saharan Africa.

The research consisted of interviews with executives from 35 small- and medium-enterprises (SMEs) and climate investment firms, as well as an extensive review of related research. The report gauges the potential contribution to climate adaptation and mitigation of these value chains and to identify finance vehicles and policy reforms needed to scale interventions in those value chains.

Download the full report (pdf, 9.5mb)

Scaling low-carbon agriculture SMEs would unlock significant adaptation, mitigation, and development benefits

Solar and other renewables are enabling distributed, low-cost cold storage, irrigation, and processing capabilities that could be transformative for rural communities in Africa and South Asia.

The research found that:

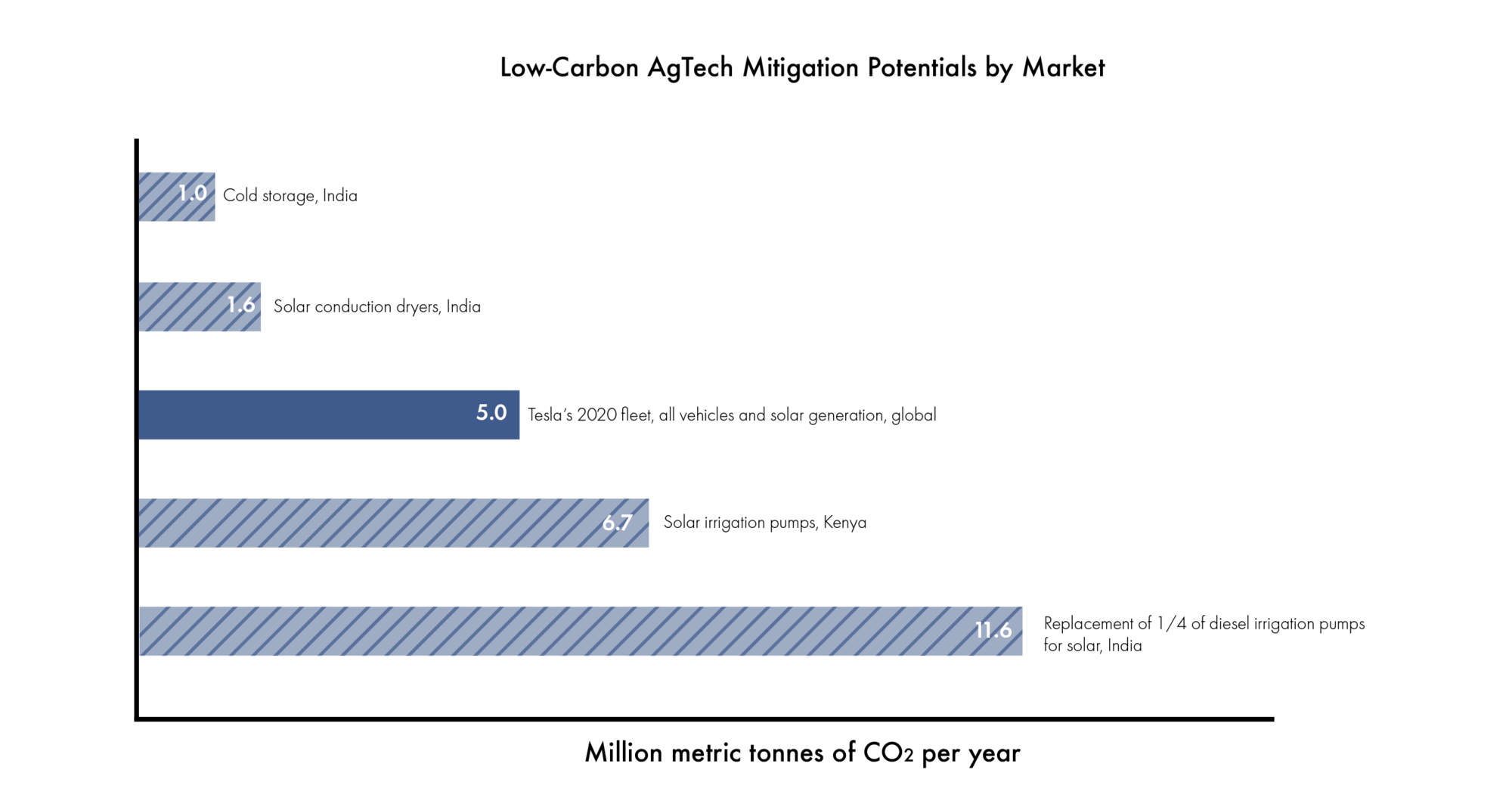

- Investing just over $200 million to provide solar irrigation pumps to 1.3 million farmers in Kenya would avert emissions of 6.7 million tons of CO2 annually

- Investing $10 million into solar conduction dryers in India would reduce CO2 emissions by 1.6 million tons per year.

- Investing approximately $750 million into solar cold storage in India would permit SMEs to deploy 50,000 cold storage units across the country, averting the emission of 1 million tons of CO2 per year.

- Replacing just one-quarter of the 8.8 million diesel irrigation pumps in India with solar pumps, which would require an investment of approximately $3.3 billion, would reduce CO2 emissions by 11.5 million tons per year.

While mitigation benefits may be easier to measure and market, the adaptation benefits provided by the sector are where its climate change value is arguably greater

The small enterprises that make up value chains tend to have deep understanding of local markets where incomes are generally low and climate vulnerabilities high. Their ability to address food and income insecurity are potentially transformative, but not adequately understood.

The types of adaptation benefits AgTech value chains can deliver include higher yields and higher quality produce; reduced post-harvest loss; increased local bargaining power; reduced operating costs; and increased nutritional diversity. They can also provide benefits with relatively weaker ties to resilience that are nonetheless relevant to broader development objectives: enhanced gender empowerment; improved air quality and health; ecosystem services such as improved soil quality and reduced erosion; and time savings, which can lead to enhanced education outcomes as well as other benefits arising from reallocation of time for beneficial purposes.

These adaptation benefits are much harder to quantify than mitigation benefits and can be highly variable across value chains and geographies. Currently, the evidence base is not sufficiently robust to help investors and SMEs quantify the extent to which AgTech investments lead to improved community resilience and development. This disconnect is a key reason why private sector approaches for delivering adaptation may be failing to attract climate finance.

Download the full report (pdf, 9.5mb)