India Ag Financing Impact Report shows 600k farmers reached in first two years

The Covid-19 Response Programme for Agri-transition in India was established in 2021 to connect smallholder farmers with essential finance and resources. In its second annual impact report it has demonstrated a sharp intake in the number and size of loans reaching farmers, with outsized reach to female farmers. Despite these success metrics, there remains an underutilisation of the Technical Assistance facility element of the programme.

Download the Monitoring, Evaluation and Learning for the Covid-19 Response Fund for Agri-Transition in India Report

The eight-year Response Programme was established through collaboration between Rabo Foundation, Ikea Foundation, the United States International Development Finance Corporation (USDFC), and Shell Foundation (with co-funding from the UK government through our catalysing agriculture partnership.

It absorbs risk for local Indian Financial Service Providers (FSP) through a joint guarantee so that the FSPs can provide more appropriate credit to farmers.

A second-year acceleration of loans with low default rates

The second-year impact report – compiled by a third-party consultant – shows positive growth of the programme across several metrics.

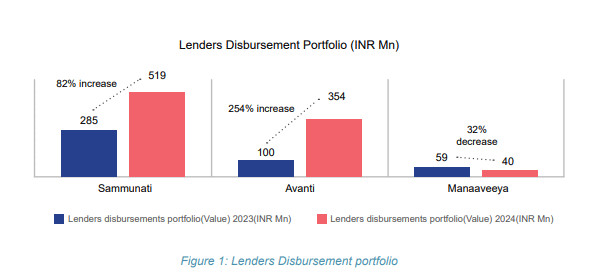

Two of the local FSPs, Sammunati and Avanti, increased their disbursements by 82% and 254% respectively. The third lender, Manaaveeya, saw a slight decrease in disbursements against its year one levels but has still managed to put nearly 100m INR into the market.

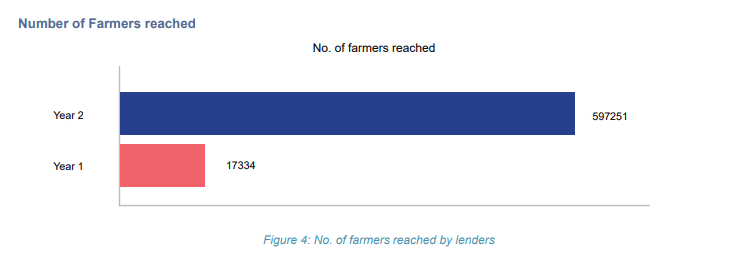

In entirety, the lenders’ disbursement portfolio grew from 444m INR to 913m INR, representing a more than 100% year-on-year increase. This increase in portfolio saw the number of farmers reached by lenders rise from 17,334 in Year 1 to 597,251 in Year 2, a 33x growth rate.

Who is receiving loans and support?

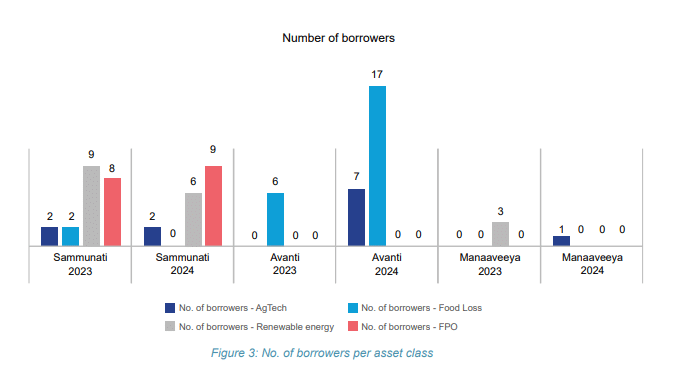

The guarantee programme is enabling local lenders to finance ‘high-risk’ agricultural enterprises such as Farmer Producer Organisations (FPOs), Agtech businesses, Renewable Energy and Food Loss Solutions Enterprises, with the backing of a credit guarantee extended by USDFC. These farmer-focused organisations gain greater access to finance while allowing lenders to build track records with these asset classes to provide more credit in the future.

- Farmer Producer Organisations: Represent farmer collectives involved in various activities like crop aggregation and processing.

- Renewable Energy enterprises: Utilise renewable energy for services like solar coolers and dryers.

- Agtech businesses: Use digital technologies and IoT for farmer assistance.

- Food loss enterprises: Tackle post-harvest losses through smart warehousing and related services.

How is it impacting farmers’ lives?

The report presents several impact criteria for the end-user farmer. The programme was designed to increase incomes while cutting emissions and reducing food loss for the farmers. 225 farmers were surveyed from five different Indian states and representing a cross-section of all four asset classes.

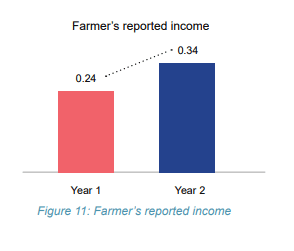

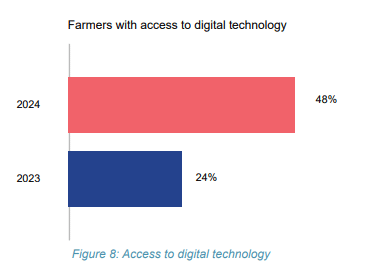

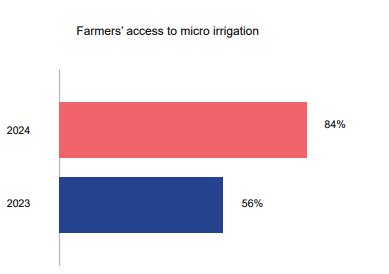

There was a noticeable growth in incomes year-on-year, as well as growth of farmers with access to digital technology and irrigation.

Technical Assistance remains underutilised, and there are opportunities to include gender indicators across asset classes

The programme has intentional gender targets, recognising that women often face multiple layers of exclusion when it comes to accessing credit. A minimum of 50% of the FPO members must be female; the report recommends similar style targets to be applied to the other borrower classes, though concedes there are critical challenges posed by the shortage of women-led enterprises.

The report highlights the lack of utilisation of the Technical Assistance element of the Response Programme, and specifically highlights the potential for it to be used to introduce gender-specific indicators for AgTech providers, Renewable Energy and Food Loss enterprises.

Increasing the incomes of smallholder farmers living in poverty is a critical pillar of Shell Foundation’s strategy and customer focus. Increasing incomes while cutting emissions is key to a holistic and far-reaching energy transition.

The evaluation of the Response Programme in India in its second-year highlights notable advancements across all facets: lender activity, and farmer impact. There are several signs of positive change, including lenders’ increased readiness to support borrowers, and those borrowers’ utilisation of clean technology which increases resilience and incomes.

We share these learnings in order to help any and all organisations working to empower smallholder farmers in emerging markets.