Improving effectiveness of guarantees to encourage growth

Guarantees can attract investors needed to fill financing gaps in the agriculture sector in emerging markets. A guarantee is a financial tool that reduces the risk for investors and leaders by ensuring that they will be compensated if the borrower defaults; thus, they can bring in new capital and open new markets. To achieve this however, guarantees need to be designed and implemented with care. Effectiveness depends on an ecosystem approach – identifying the roles of various stakeholders depending on the guarantee type and target – and knowledge sharing on design and implementation.

Open Capital, with funding from Shell Foundation and the UK’s Foreign, Commonwealth and Development Office (FCDO), has conducted a comprehensive research report on how to improve the effectiveness of guarantees.

In 2024, guarantees were deemed official development assistance (ODA) eligible. This decision is expected to result in more issuing and/or funding guarantees. The research explores how donors can use guarantees to effectively catalyse additional funding, and the roles other organisations can play to support lending in the agriculture space. It addresses knowledge gaps that limit funders’ ability to unlock new investment across sub-Saharan Africa.

Stakeholder landscaping; recommendations on design and implementation

A stakeholder landscaping identifies the roles of guarantors, donors/funders and lenders, and examples of organisations playing each role. The research then provides seven key recommendations for effective design and implementation of guarantees.

Design recommendations include sections on structuring and terms, as well as how to blend guarantees with complementary finance instruments such as insurance, incentives and results-based financing (RBF). Implementation recommendations encourage understanding of local context and realities and providing Technical Assistance. There is emphasis on managing ongoing operations and effective Monitoring & Evaluation.

Research grounded in real-life case studies

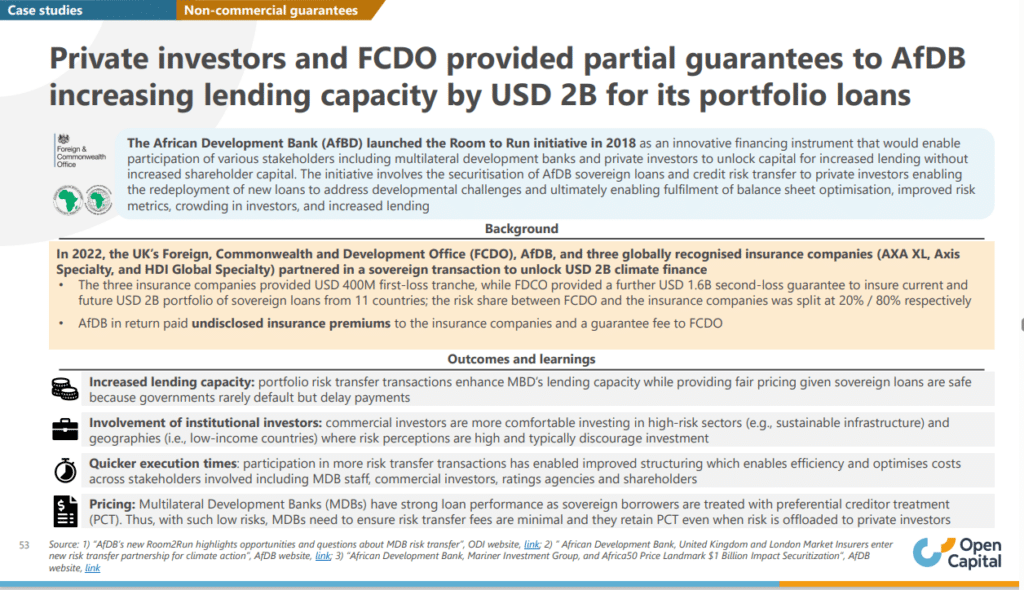

Open Capital conducted a literature review and stakeholder consultation exercise to produce the research. In the process they were able to gather real-world, operational case studies on commercial and non-commercial guarantees as well as project finance guarantees. The case studies provide background, problem statements and demonstrable outcomes and learnings.

Included in the case studies are guarantees created by the Africa Development Bank, Aceli, Rabo Foundation, GuarantCo, and the FCDO, among others. They include working examples from Kenya, Nigeria, India and Uganda.

Unlocking new investment for the agriculture sector is critical

At Shell Foundation, we are committed to raising incomes while lowering emissions for millions of smallholder farmers across Africa and South Asia. Unlocking new investment for the agriculture sector is critical to this goal.

Guarantees can play a critical role. They can close the gap between perceived and actual risk of agri-lending in emerging markets and enable donors to catalyse additional funding into critical technologies, markets and sectors.

This new research addresses the knowledge gaps that might limit funders’ ability to use guarantees effectively. If you are interested in discussing the research and how your organisation can learn from it, please get in touch.

Shell Foundation and FCDO’s funding of the Guarantees research is part of our Catalysing Agriculture partnership. Find out more.

Latest news and updates

How solar irrigation is transforming the lives of smallholder farmers in Kenya – lessons and the road ahead

Solar-powered irrigation is helping smallholder farmers in Kenya build resilience to climate shocks, improve nutrition, and reduce post-harvest losses.

28th January 2026

Building climate change resilience: The impact of cold chain adoption for Lake Turkana’s fishers

Cold chain adoption helps Lake Turkana fishers reduce spoilage, increase incomes, and build resilience to climate change.

09th December 2025