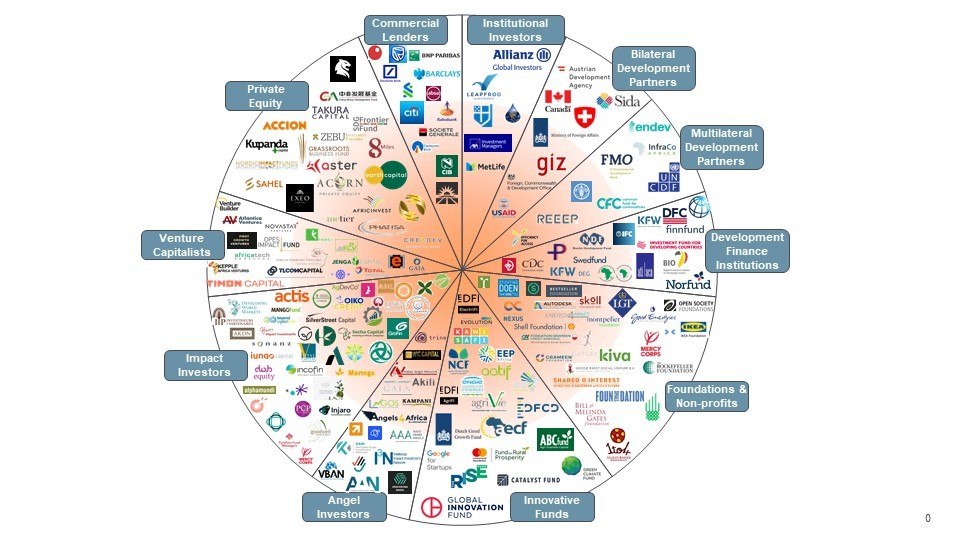

Mapping the ecosystem of current and potential Agriculture-Energy investors

The African agribusiness sector could reach US$1 trillion by 2030,1 creating jobs and wealth. Yet, this is predicated on accessing those essential energy services that enable farmers to grow, irrigate, harvest, refrigerate, process, and transport crops. Enterprises at the intersection of agriculture and energy present an exciting opportunity for investors across the spectrum of capital, with significant potential for impact among the most underserved populations.

As part of the Catalysing Agriculture by Scaling Energy Ecosystems (CASEE) programme between Shell Foundation and the UK Government, which aims to help scale a range of enterprises and promote resource mobilisation in the agri-energy ecosystem, we have published new research to identify current and potential investors and share insights aimed at stimulating new partnerships.

A multi-stage methodology

The mapping exercise followed a multistage process to ensure relevance and accuracy:

Identification of funders & investors

We reviewed a wide selection of funders and investors who are active or have the potential to be active in the agri-energy space, building on proprietary and public databases and professional networks.

Characterisation of the universe

Using public information and our professional insight, we characterised funders and investors against key criteria and lenses to identify their preferred funding modalities and pathways through which they do (or could) invest.

Consolidation and validation

We consolidated a list of 211 high-potential funders and investors, mapped against key criteria. Prior to publication, the universe was compared with external datasets and peer reviewed by experts, including CASA, to validate the findings.

In a first release in October 2021, we launched a structured funders and investors map/database. This includes funders and investors that are already active in the agri-energy space and others who could potentially become interested based on their key impact drivers. Enterprises can use this database to identify suitable investors based on their impact thesis, sectoral focus, quantum of capital and type of capital available, which can help them better tailor their value proposition to investors.

We have partnered with the CASA Programme who have published a live version of the database

This database is now complemented with an insights report, created after interviewing a carefully selected subset and our professional networks, in order to: move beyond the ‘known’ universe; map potential interfaces between agri-energy and other themes; and systematically collect information to facilitate collaboration opportunities –to better enable enterprises to access funding and funders to deploy it. We have also published focused profiles of selected funders aimed at increasing transparency for enterprises and stimulating the creation of new partnerships between funders.

Resources/Downloads

|

INSIGHTS REPORT & FUNDER PROFILES (PDF, 3MB) |

| LIVE INVESTOR DATABASE ON CASA WEBSITE | |

| Methodology report (pdf, 3mb) | |

| pdf investor database (pdf, <1mb) |