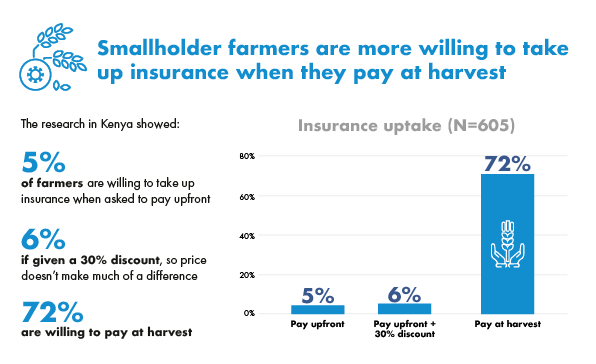

Pay-at-Harvest increases insurance uptake by 14x in Nigeria

to provide innovative agricultural insurance that helps smallholder farmers and rural clients endure climate risks, improve farming practices, and bolster their profits.

to provide innovative agricultural insurance that helps smallholder farmers and rural clients endure climate risks, improve farming practices, and bolster their profits.

Pula carried out an insurance pilot in 2021 in Nigeria that explored a Pay-at-Harvest (PAH) model that seeks to address farmers’ liquidity constraints. The pilot was structured to allow farmers to receive insurance cover at the start of a season but pay the premium after they have harvested and sold their produce, when more disposable income is available.

The pilot surfaced some key findings and recommendations lessons, that are presented in a visual learning report.

Download the Learning Report (pdf, 6mb)

Download the Learning Report (pdf, 6mb)

PAH Feasibility Study identifies high-potential value chains

A second report presents feasible opportunities for PAH insurance in various Asian and African countries. Select value chains are identified as being better suited to PAH insurance. These include organic cotton, certified cocoa, as well as some alcoholic beverage value chains.

This report is aimed at potential stakeholders in the PAH insurance value chain, including impact investors, crop aggregators, agro-processors and distributors, insurers and reinsurers, as well as development organisations.