Findings based on 20 years of working on energy access

At Shell Foundation, we have been working to address this access to energy gap for nearly two decades; more recently in partnership with structured co-funding partnerships with DFID and USAID.

Our commitment to accessible energy has led us to support various energy solutions, including solar home systems (SHS), biomass cookstoves, powered agricultural equipment, mini-grids and various financing intermediaries, improving the lives of over 60 million low-income people across Africa and Asia.

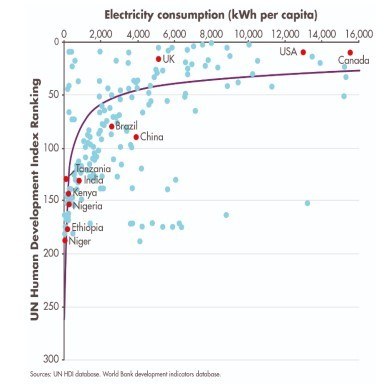

We do this because the meeting of complete energy needs of low-income consumers is essential to unlocking the development of emerging markets. Almost all countries with less than 2000KWH per person are at the bottom of the UN Human Development Index (see chart.)

Our experience working with mini-grids – beginning with Husk Power Systems in 2008 – has helped us understand how business models would need to evolve to utility standards in order to be successful in the long term, including the critical adoption of 24-hour residential and commercial services, demand stimulation and smart metering.