Three visions for the future

The research, supported by The Rockefeller Foundation and Shell Foundation, and benefiting from technical advice from IKEA Foundation, The Rocky Mountain Institute, Sustainable Energy for All, is the first of its kind on several fronts and will be followed by a series of country deep dives. It combines historical trends analysis, extensive financial modelling and a full lifecycle analysis of energy sources to produce three feasible scenarios to meet the energy needs of rural households and small and medium enterprises in Africa, with varying levels of reliance on DRE and grid extension.

The study’s business-as-usual scenario paints a stark picture. On current projections 31% of African households would still be unelectrified by 2030, with the use of polluting, expensive backup generators increasing (two-thirds of electricity grids in Africa are unreliable, spurring the use of seven million backup generators today that consume $13bn worth of fossil fuels annually). Over 230 million households would continue to cook with solid fuels, a practice that is a leading cause of the household air pollution that claims 600,000 African lives each year and significant deforestation.

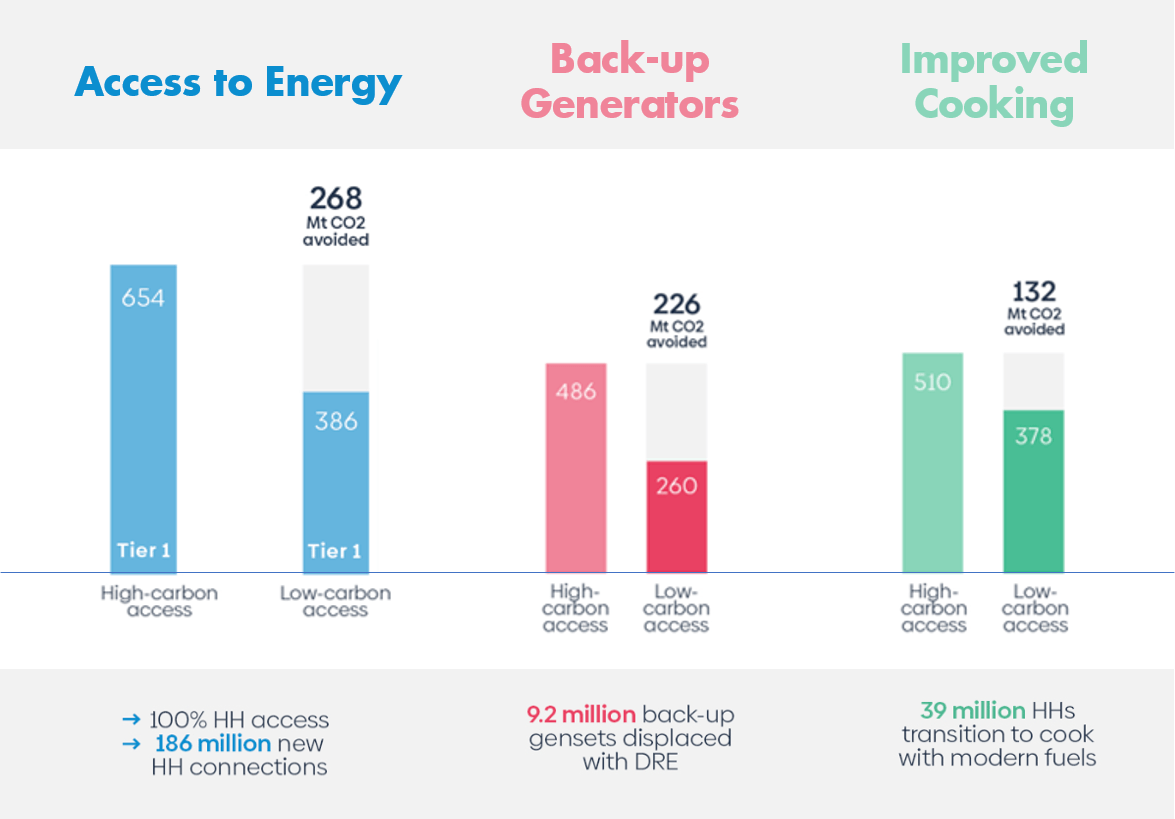

Two further scenarios are explored: one low carbon and one high carbon, in which 100% access to electricity is achieved, alongside improved grid reliability and a more marked transition to cleaner cooking.

The low-carbon scenario relies on more extensive use of DRE technology to achieve 100% household electricity access and replaces 9.2 million fossil-fuel powered backup gensets with solar alternatives. While noting that Africa’s cooking crisis will be difficult to solve, the researchers believe it is feasible to shift at least 39 million households from cooking with charcoal to using modern, less CO2-intensive energy sources like LPG or electricity.

Under this scenario, Africa avoids up to 626 m/t CO2e emissions compared to a high-carbon scenario − the approximate equivalent to the annual emissions of 160 coal-fired power plants, or 933 million round-trip flights between London and New York City. This is also the lowest-cost way to generate inclusive economic growth.