The COP28 agreement to “transition away” from fossil fuels introduces new urgency to develop and scale alternative energy sources, especially in emerging markets. The path ahead must also secure economic empowerment for millions of people across the Global South, to ensure the agreement lives up to its mandate to transition in a “just, orderly and equitable manner.”

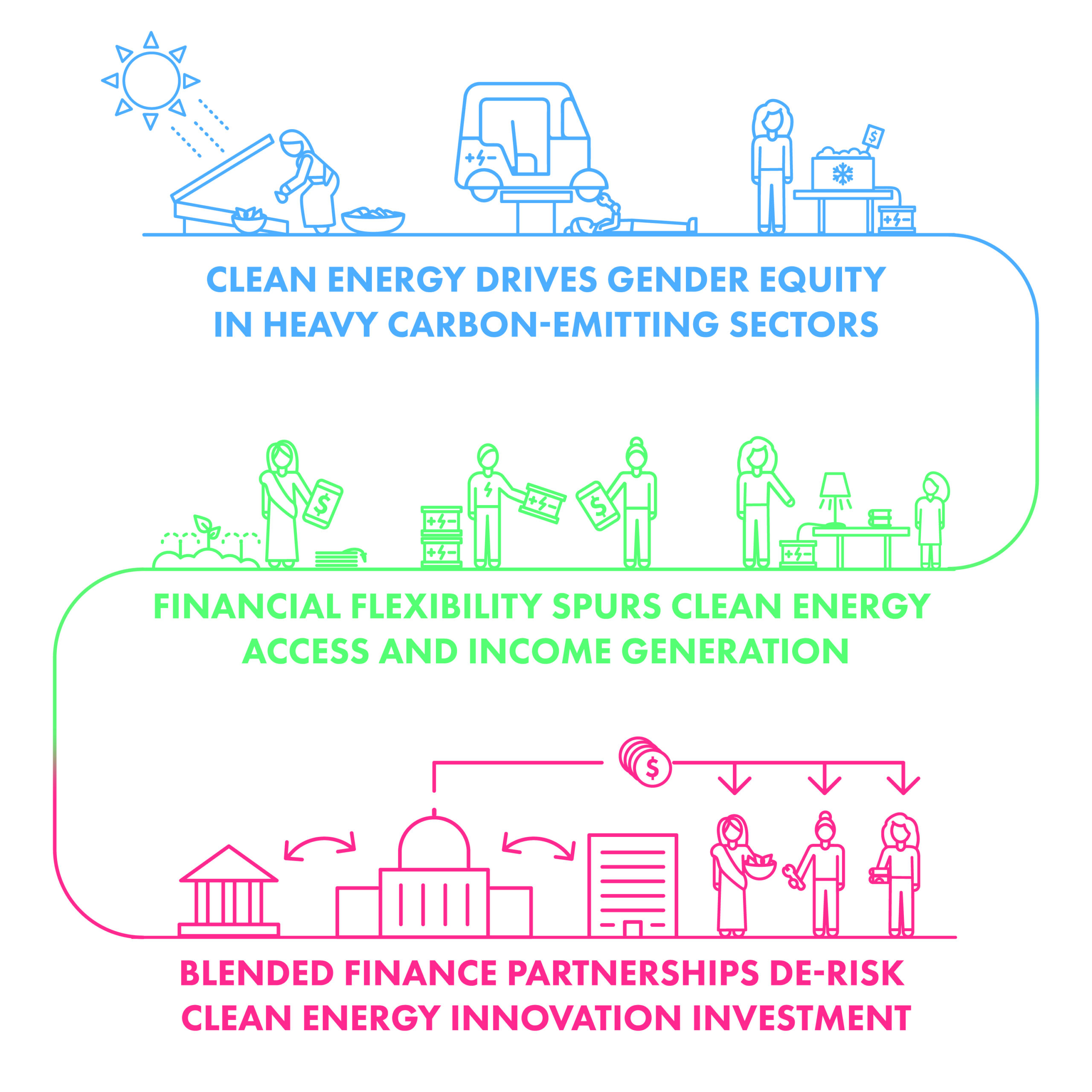

Solutions that meet the needs of the climate while supporting global development goals on poverty, gender equity, and access to energy require innovation and creativity to create sustainable and scalable outcomes. Based on more than two decades of work within the Global South, Shell Foundation (SF) has identified two untapped power sources that should be primed to deliver breakthroughs in clean energy access:

- Gender equity – through designing female empowerment into the methodology and goals of investments, especially in the transport and farming sectors.

Financial flexibility – through the creation of new and innovative financial products that steer global climate finance directly into the hands of those most affected by climate change.

Both sources highlight the need for blended, symbiotic partnership models that adjust for respective risk profiles, experience and expertise, and leverage local knowledge and reach to create deep and sustainable impact at scale. Shell Foundation’s partnerships have already invested in climate technology projects with vast opportunities to scale but these represent only a small portion of what could be achieved for people as well as the planet.

S4S Technologies, a food tech start-up, has partnered with Shell Foundation since 2018 to scale its climate technology in India and around the world. S4S utilises a revolutionary solar dehydration technology at an affordable price for rural communities, ensuring they can process their food onsite and reduce waste. SF’s investment in S4S’s work has already yielded benefits for over 300,000 female smallholder farmers, including a 10-15% increase in their profits.

S4S Technologies, a food tech start-up, has partnered with Shell Foundation since 2018 to scale its climate technology in India and around the world. S4S utilises a revolutionary solar dehydration technology at an affordable price for rural communities, ensuring they can process their food onsite and reduce waste. SF’s investment in S4S’s work has already yielded benefits for over 300,000 female smallholder farmers, including a 10-15% increase in their profits.